Weekly Recap Research 08 - 14 Dec 2025

Week of December 08 - 14, 2022

_progressive.jpg)

Weekly Recap Research

Major shareholder Exor rejects Tether's offer to buy Juventus football club

The stablecoin giant, which currently holds around 10% stake in Juventus, has filed an offer to buy all 65.4% of the Agnelli family, a major shareholder of soccer club Juventus and global holding company Exor, as an all-cash acquisition. However, Exor's board has had its say. It unanimously rejected Tether's offer, explicitly stating in a statement on Saturday that the company did not intend to sell any shares in Juventus to third parties, including Tether from El Salvador. Tether recently announced its intention to officially acquire Exor shares, and expressed its appreciation for the club. This football, and stating that it will invest another $1 billion if the offer is accepted, currently Tether already holds 10% of Juventus shares and has consistently shown its desire to play a more strategic role within the club.

Juventus won their last Serie A championship in 2020 before the club was hit hard by the COVID-19 pandemic, resulting in continued losses and led to the decision to sell superstar players like Cristiano Ronaldo in 2021. Over the years, the club has faced financial pressure from a lack of results. Capital is redundant and requires constant capital increases, totaling more than 1 billion euros, or about $1.17 billion, over a seven-year period, with Exor stating that Tether's offer was an unsolicited offer, while reiterating that the Agnelli family remains committed and committed to the club as it once was. Juventus are seen as a club with With a long and successful history, Exor and the Agnelli family have been major shareholders for more than 100 years and remain committed to supporting the club, including a new set of management teams, in driving their strategy to strengthen both on and off the pitch.

In terms of market response, the price of tokens linked to the “JUV” club rose to $0.7849, rising by more than 32% within 24 hours of the disclosure of Tether's acquisition intentions. However, at the time of the report, no clear reaction has been seen from the market to Exor's rejection of such an offer, the current issuer of Tether. Major stablecoin, holding 11.53% of Juventus shares, is the second-largest shareholder after Exor, while Juventus shares fell 0.9 percent to 2.194 euros, or $2.58, after Friday's close, bringing the club's market value to around 988. Million Dollars

Strategy remains on the Nasdaq 100

The Bitcoin Treasury strategy continues to remain on the Nasdaq 100 after the index announced its annual portfolio adjustment last Friday, with Nasdaq stating that the restructuring will take effect before the market opens on Monday, December 22, 2025. Previously, some analysts expressed concern that the software company, formerly known as MicroStrategy, or now Strategy, may be It was removed from the index after its share price slumped sharply this year, though the company was recently added to the Nasdaq 100 in December 2024 on the back of a remarkably bullish stock price boost now. Shares of Strategy (NASDAQ: MSTR) are down more than 40% since the start of the year as some market analysts see the company beginning to shoulder a high level of debt. Strategy, formerly a software business, began buying its first Bitcoin in 2020 to use it as a hedge against inflation and boost its returns to shareholders during the COVID-19 pandemic. The company later adjusted its image. Becoming a full-fledged Bitcoin Treasury Firm, it offers investors the opportunity to invest in shares to gain exposure to the world's leading crypto through the issuance of debt instruments to continuously accumulate Bitcoin, and today it has become a company that Holds the most Bitcoin, with 660,624 BTC, worth about $59.5 billion at current prices.

In recent years, hundreds of public companies have followed Strategy's model by acquiring Bitcoin and other cryptos in anticipation of a rise in share values. In the early stages, quite a few companies have seen their share prices rise significantly. However, as the volatility of the crypto market increases this year, the picture has started to change, reports BitcoinRetail. According to Uries.net, about 60% of companies holding Bitcoin are currently at a loss compared to the cost of acquisition, even though Strategy's shares have risen by more than 1,120 percent since the company began taking its Bitcoin buying strategy seriously in August. 2020, however, the crypto market's adjustment in 2025 resulted in the stock falling from its all-time high in November 2024, near $474, before closing its most recent trade at around $176 per share. Meanwhile, the price of Bitcoin is down nearly 30% from its all-time high in October of $126,080 to around $90,180. Dollar to coin, resulting in the return of the world's number one digital asset since the beginning of the year, remaining slightly negative, around 4%.

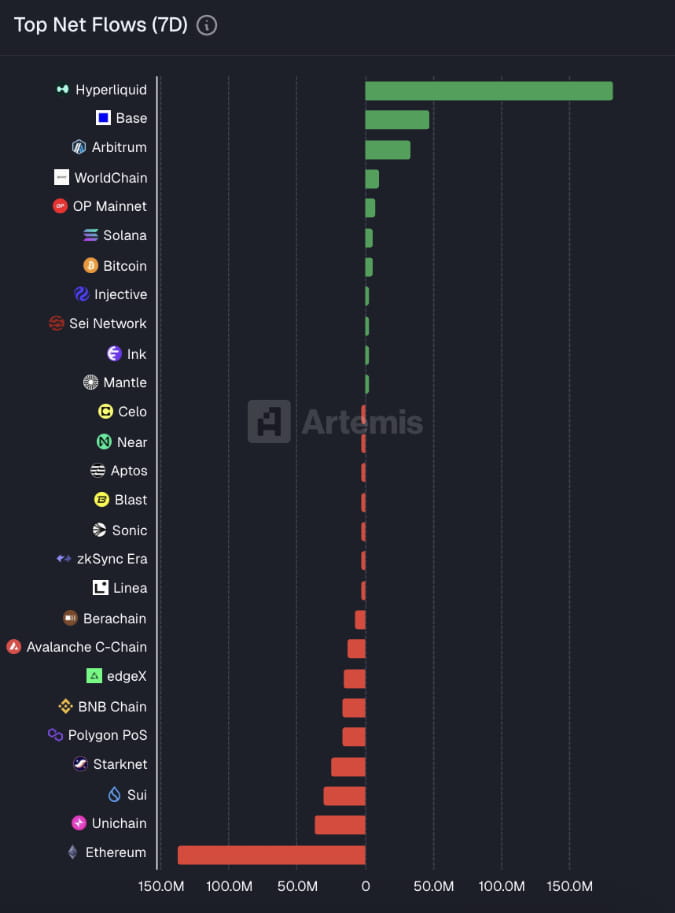

Top Net flows

Over the past week, the overall picture of net flows across the various networks reflected the behavior of users and investors. It became clearer that the market was beginning to pick sides, with a clear dominant winner, Hyperliquid, which received the highest inflow pellets compared to any network at around $182 million, reflecting its rapidly accelerating popularity as Trading platforms and an expanding ecosystem, meanwhile, Layer 2 offshore networks like Base, Arbitrum, and OP Mainnet, as well as major blockchains like Solana and even Bitcoin itself, continue to have cash inflows as well, even though the numbers aren't as striking as the leaders. The overview also indicates that the silver bullet continues to move towards low-cost, high-speed, and constantly evolving networks.

In contrast, the network that faced the most outflows this week was Ethereum, which lost a high level of liquidity to become the network with clearly the highest Net Outflow at around $137 million. The situation echoes a common behavior in the latter market, that of moving capital from Layer 1 with high fee costs to more agile platforms such as networks. Layer 2 and new generation chains with incentives attract higher users. In addition, networks such as Polygon PoS, BNB Chain, Avalanche, Starknet, Sui, and Unicchain are all facing ongoing cash outflows as well, which may reflect. The effects of market fluctuations or activities within ecosystems that have not yet been able to expand as expected.

Fear & Greed Index

The Crypto Fear & Greed Index is one of the tools used to assess the outlook and sentiment of the crypto market, referring to scores ranging from 0 to 100 (0 stands for Extreme Fear or Extreme Fear and 100 stands for Extreme Greed).

The latest Crypto Fear & Greed Index fell to level 17, which is clearly positioned in the Extreme Fear zone, reflecting a very high level of market fear. The condition comes amid continued selling forces and macro-factor uncertainty that has pressured digital asset prices throughout the past month, as well as over the past 30 days. The Fed has not been able to recover back into the middle or positive zone at all, indicating that market sentiment continues to weaken.

During the same period, Bitcoin's price chart moves in line with the direction of the index, with the price continuing to decline as the level above $110,000 fell to the area below $90,000. Market concerns intensified as the index plunged to several lows, while liquidity from major players has yet to return to adequate levels. Price support can, however, behaviorally, a period when the index is in the Extreme Fear zone is often seen as a rhythm that some investors use for long-term accumulation, with historical data from several crypto markets suggesting that extreme fear often occurs before recovery periods, even if not. Reversal points can be clearly identified

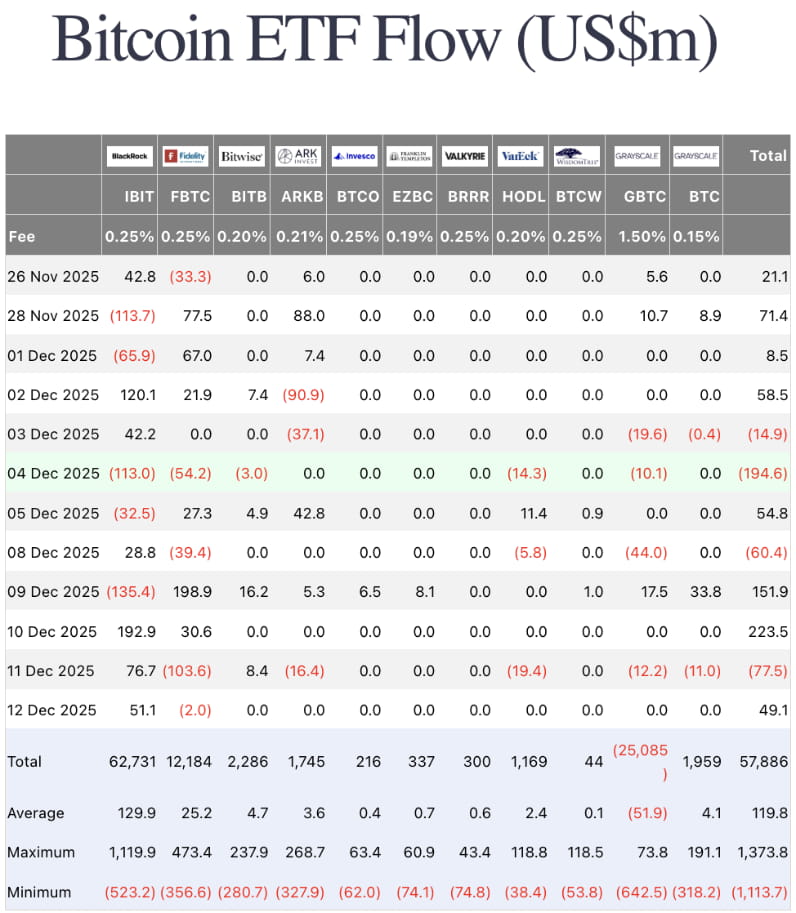

Bitcoin ETF Flow

The Bitcoin ETF's cash flow table in the middle of the final quarter of 2025 reflects a clear picture that the market is under continued selling power, particularly from some of the larger funds that were previously the main drivers during the bull market. Price volatility and downward directional pressure have resulted in many funds returning to a net sell-side position rather than buying. Looking back over the past week, December 8 started to see another uptick in sales, with a negative overall day of about $60 million, while on December 9, cash flows from IBIT funds reached $135 million, which counted as an outflow level at Most of this fund in the past 30 days. However, on the same day, the overall market closed positive at $151.9 million, as other funds took in large amounts of money, especially FBTC with inflows of more than $198.9 million. Later on December 10, the IBIT fund reversed direction from the previous day with inflows reaching 192.9 million. The dollar, along with an additional $30.6 million in net inflows from FBTC, but the situation could not maintain continuity. On December 11, net cash flows returned to negative again, including around $77.5 million for the day, with the main outflow from FBTC at $103.6 million total. As for the rest of the funds, even on the same day, IBIT had $76.7 million in inflows, it was still not enough to offset the entire sales force. As of December 12, the overall net cash flow was not much changed, closing the day with a net inflow of about $49.1 million.

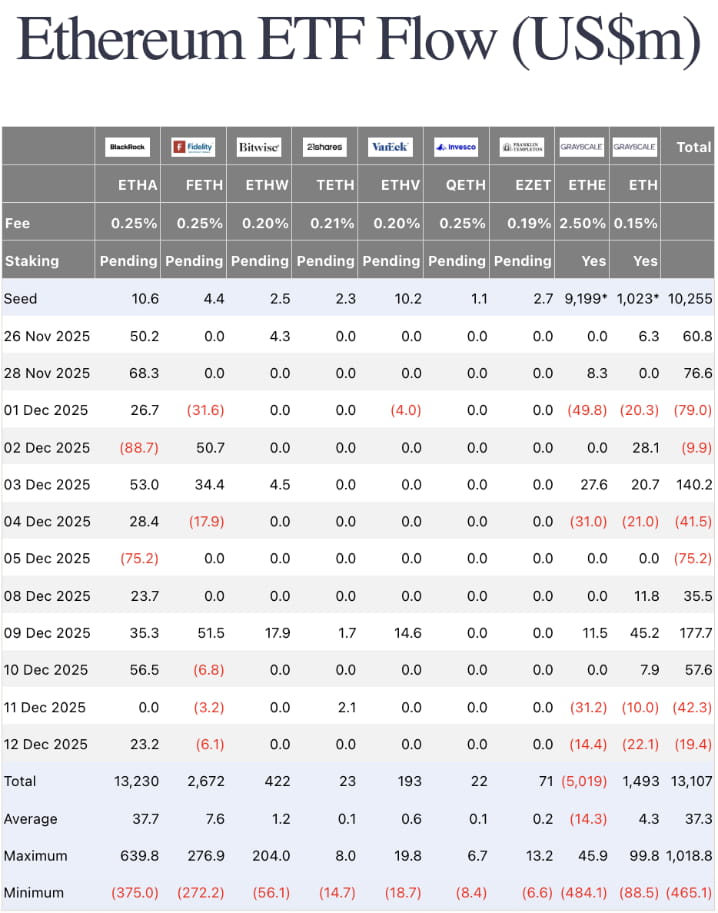

Ethereum ETF Flow

The period of December 8—14 is the week in which the Ethereum ETF's cash flow signals a recovery in a semi-bearish manner. Investors have yet to show full confidence. Despite seeing stronger buying forces in some periods, the sell-off from legacy funds such as Grayscale continues to act as a drag on the overall direction of the market. The overview data reflects Capital movements that still lack directional clarity

According to the current figures, there were three consecutive days of net inflows, with inflows of about $35.5 million on December 8, increasing to about $177.7 million on December 9, mainly from ETHA, FETH and ETHW funds, and on December 10, there was an inflow of about $57.6 million. However, the picture was partially refuted in the period. Next, on December 11 and 12, cash flows returned negative on both days, with December 11 having net outflows of about $42.3 million and December 12, around $19.4 million, with the main selling force still coming from Grayscale's funds on both days.

Important news:

Trump's views on interest rates won't have any weight on the Fed's decision, Hassett said.

Source:

https://www.ft.com/content/08586db5-0af1-4a8c-940f-3fc36b481223

https://www.dlnews.com/articles/markets/bitcoin-giant-strategy-nasdaq-100

https://coinpaper.com/13097/strategy-holds-nasdaq-100-spot-as-mstr-chart-points-to-100-call

Note: This analysis is provided every Monday, so some articles may have data discrepancies.

Nota: Questo analisi è situato ogni monday, quindi alcuni parti del articolo possono contengono informazioni inaccurati

WARNING: CRYPTOCURRENCIES AND DIGITAL TOKENS ARE HIGHLY RISKY. YOU MAY LOSE YOUR ENTIRE INVESTMENT. PLEASE STUDY AND INVEST ACCORDING TO THE ACCEPTABLE LEVEL OF RISK.

Thank you for following.

Thanakarn

News Cryptocurrency

Download the Maxbit application at

Securely register with a digital asset trading platform regulated by Thailand’s SEC.

%20(1).avif)